Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. Click on Permohonan or Application depending on your chosen language.

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Before you say goodbye to income taxes for the rest of the year make sure to save and print the acknowledgement and e-BE form for records purposes.

. EA Form and CP8D forms are available in both English and Malay versions but the Excel versions are only available in. How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. 所以我没有拿到tax refund 请问 今年我在报2018税的时候还有可能拿得回来吗.

INCOME TAX RETURN FORM SUBMISSION BE FORM DUE DATE EXTENSION TIME Manual Form 15 MAY 2020 30 APRIL 2020 30 JUNE 2020 30 JUNE 2020. Many of the Income Tax related forms are quite difficult to find. Filing your taxes just became easier.

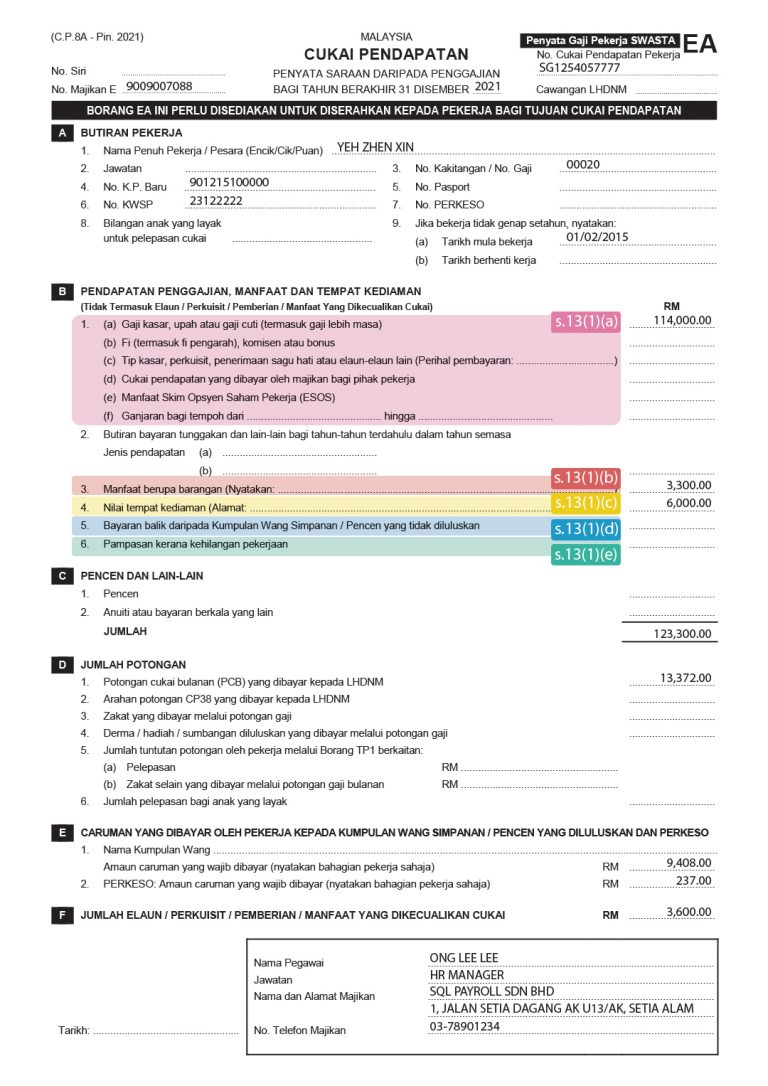

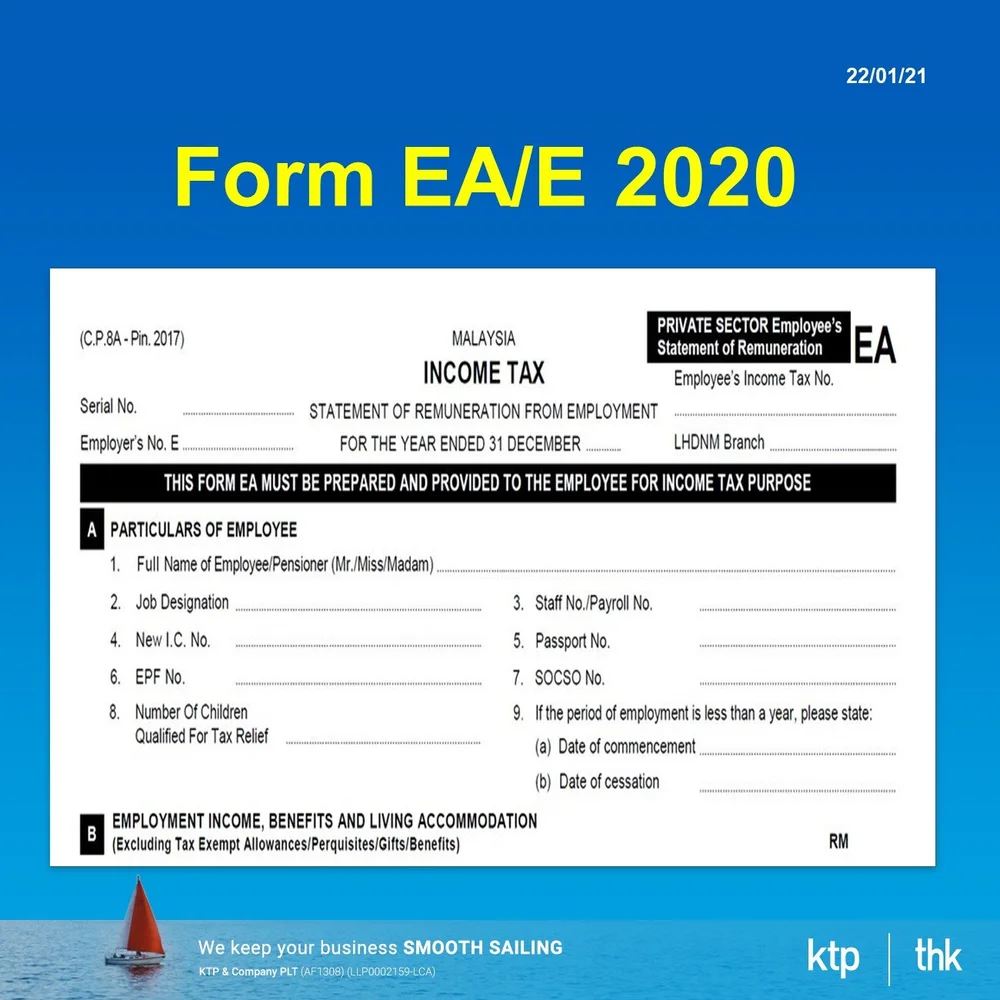

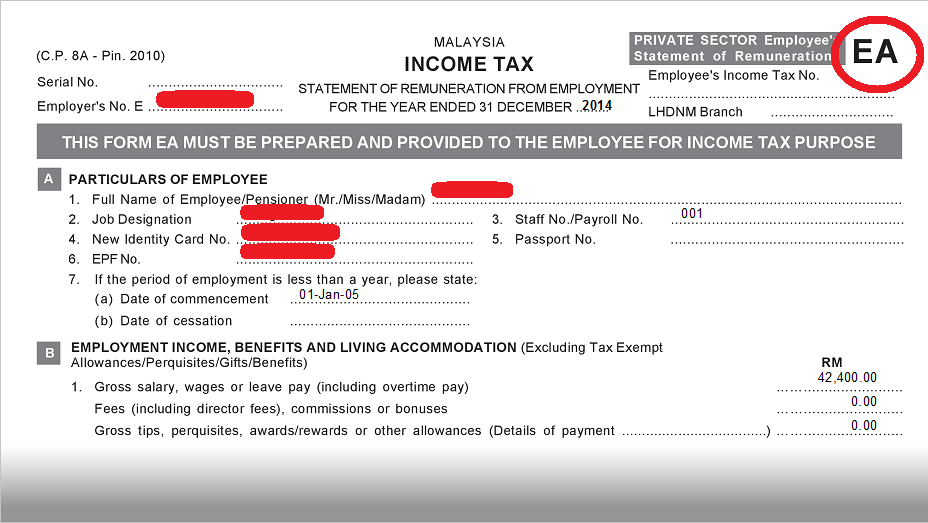

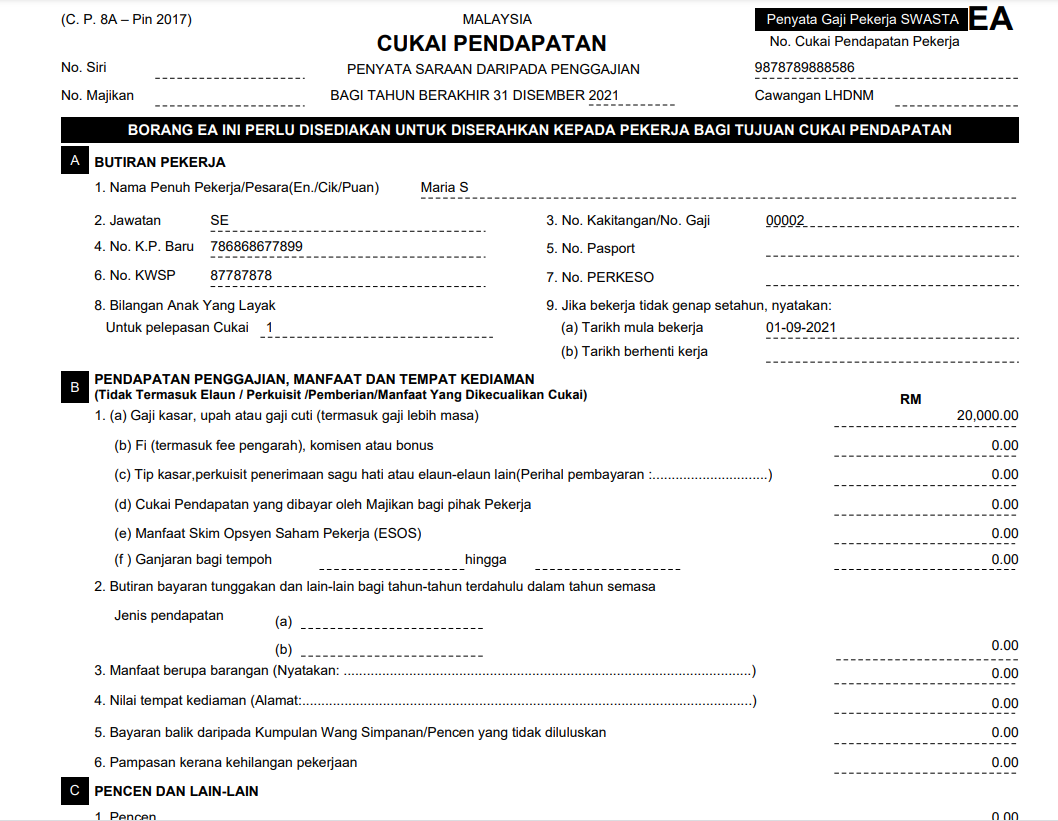

Have you gotten your EA form from your employers yet. Employment Income Enter 0 if no source of income Monthly Tax Deduction MTD Please fill in the income received from previous year. 2017 MALAYSIA INCOME TAX STATEMENT OF REMUNERATION FROM EMPLOYMENT.

30062022 15072022 for e-filing 6. Ad Import tax data online in no time with our easy to use simple tax software. As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year.

我要如何去看去年我submit 的ea form呢 多多感恩. 2017的be form中我没有填到我公司帮我还的pcb 而我的income不超过 rm 34000. Earned Income Tax Credit.

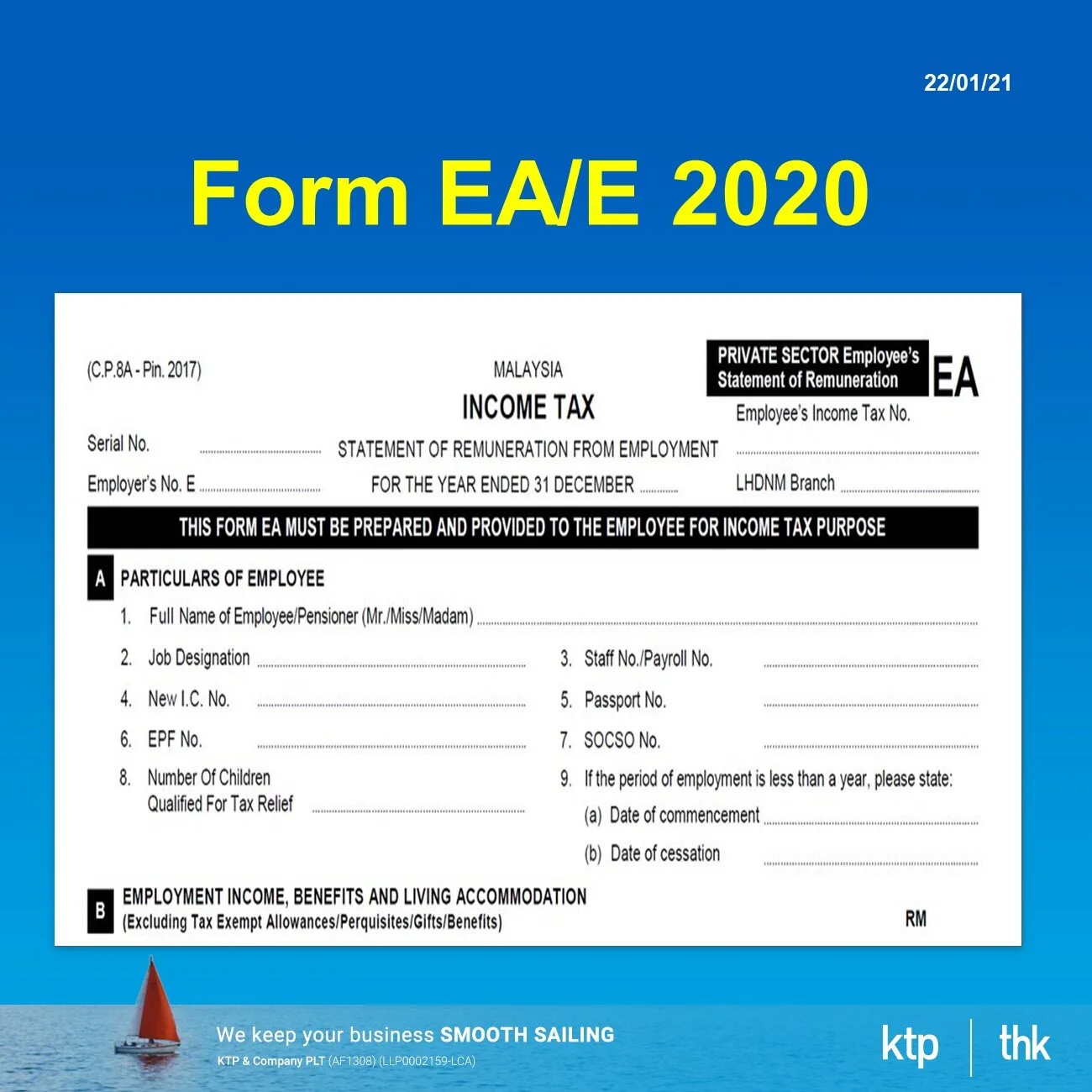

4 2 3 4 e-Filing 1. Go back to the previous page and click on Next. The EA Form is a statement of remuneration for private employees.

According to the Income Tax 1967 ITA 1967 Form EA must be given to the employees before 28th of February. It includes your previous years salary. Amending Your Income Tax Form.

You will need to refer to this to file personal taxes during tax season. Benefits in kind 1. Individual Tax Return Form 1040 Instructions.

In 2020 and 2021. The EA form is a Yearly Remuneration Statement that includes your salary for the past year. Generating Form EA in Swingvy takes a few clicks to get it out to your employees.

According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year. File your taxes stress-free online with TaxAct. Use Form 1040-ES to figure and pay your estimated tax.

In addition if you do not elect voluntary withholding you should make estimated tax payments on other taxable. And with that congratulations youre done with income tax filing for YA 2021. Click on e-Filing PIN Number Application on the left and then click on Form CP55D.

Form EA Annual income statement prepared by company to employees for tax submission purpose Deadline. In accordance with subsection 831A of the Income Tax Act 1967 ITA 1967 the Form CP8A CP8C must be prepared and rendered to the employees on or before end of February the following year to enable them to complete and submit their respective Return Form within the stipulated period. According to Malaysia Budget 2021 income tax exemption limit for compensation for loss of employment will increase from RM10000 to RM20000 for each full year of service applicable for YA.

D Income Tax borne by the Employer in respect of his Employee 3. If you are filing your taxes in 2021 then head on over to our income tax guide for YA2020 here. We have located the specific links to these forms for easy download.

On and before 3042022. This is the income tax guide for the year of assessment 2019. Request for Taxpayer Identification Number TIN and Certification.

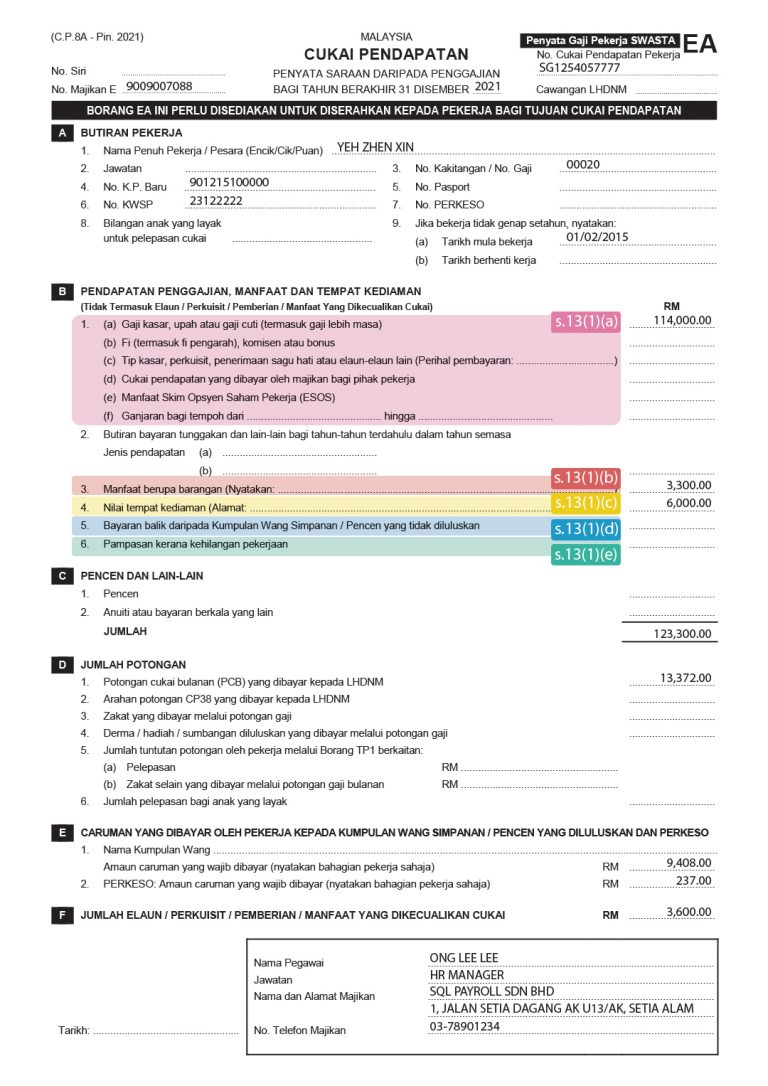

Refer to EA EC eg. Income tax season has arrived in Malaysia so lets see how ready you are to file your taxes. Some employers do not understand the content of Form EA due to language problems so we have prepared Form EA in Chinese.

EA Form meaning according to Inland Revenue Board Of Malaysia. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents. 2021 malaysia income tax statement of remuneration from employment for the year ended.

Form EA is an annual income statement prepared by a company for employees tax submission purposes. B Failure to furnish Form E on or before 31 March 2022 is an offence under paragraph 1201b of the Income Tax Act Failure to prepare and render Form EA EC to employees on or before 28 February 2022 is an offence under paragraph 1201b of ITA 1967. What is Form EA.

Tax season is the time when personal taxes are filed on the EA form. Download a copy of the form and fill in your details. The Child Tax Credit Update Portal is no longer available.

In Part F of Form EA you could file for certain tax exemptions that can reduce your overall chargeable income. What Is EA Form. What is EA Form.

Form 1040-ES Estimated Tax for Individuals Department of the Treasury Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Name of Provident Fund Amount of compulsory contribution paid state the employees share of contribution only Date CP. Only tax exempt allowances perquisites gifts benefits listed above No.

Estimated tax is the method used to pay tax on income that is not subject to withholding for example earnings from self-employment interest dividends rents alimony etc. Instructions for Form 1040 Form W-9. This form ea must be prepared and provided to the employee for income tax purpose cp8a - pin.

This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved particulars of employee employment income benefits and living accommodation. Others allowances perquisites gifts benefits which are exempted from tax but not required to be declared in Part F of Form EA are as follows. Private sector employees ea employees income tax no.

Form B Income tax return for individual with business income income other than employment income Deadline. 1 to 9 are required to be declared in Part F of Form EA. Its important to understand the various benefits-in-kind as well as.

Section 831A Income Tax Act 1967. How to generate Form EA in Swingvy. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Function Added For Excel Users To Do Ea Form Actpay Payroll

How To Fill Up Ea Form Savannagwf

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

St Partners Plt Chartered Accountants Malaysia Form Ea 2020 Statement Of Remuneration From Employment For Private Sector This Form Ea Must Be Prepared And Provided To The Employee

Ea Form Malaysia Form Ead Faveni Edu Br

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

Freelance Account Services Home Facebook

Compensation Loss Of Employment Estream Software

What Happens When Malaysians Don T File Their Taxes Update

Malaysia Payroll Compliance How To Generate Ea Form In Deskera People

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

7 Tips To File Malaysian Income Tax For Beginners

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Ea Form Sample Fill Online Printable Fillable Blank Pdffiller

Beacon Cloud Free Ea Form Generator Payroll Module Facebook By Beacon Cloud

Understanding Lhdn Form Ea Form E And Form Cp8d

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory